Taxes And Laws

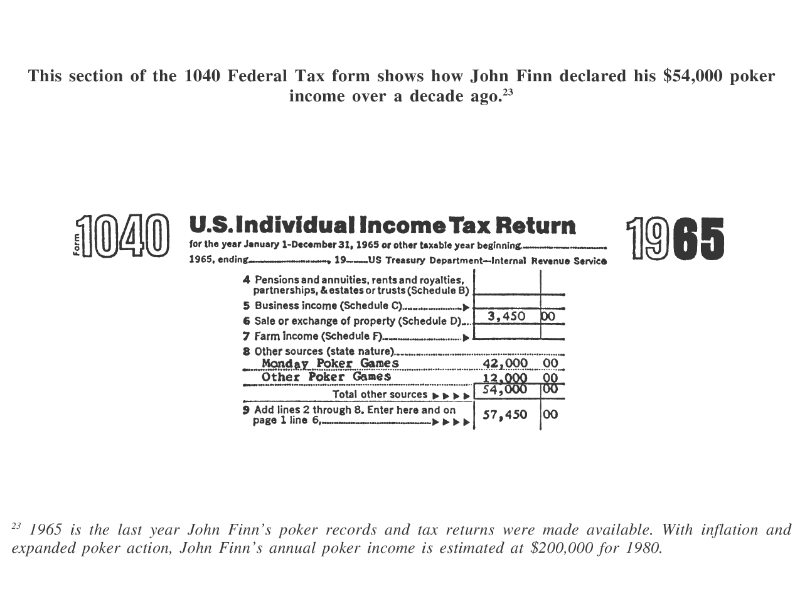

For federal tax purposes, net annual poker winnings must be declared as income.21 Poker income can be listed under the heading of “Other” on Federal Income Tax Form 1040. In most states, net poker gains can also be declared as income. Gambling losses can be deducted (on Schedule A) from poker income, but net gambling losses cannot be deducted from taxable income.

Poker players’ winnings are not subject to the federal excise taxes on gambling.22 Apparently the federal government does not classify poker players as gamblers (even though poker income is treated as gambling gains by the IRS).

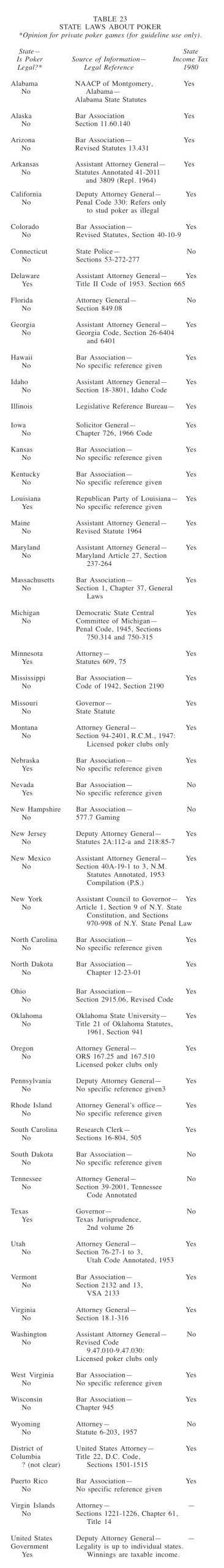

A survey by the author (summarized in Table 23) shows that poker games are technically illegal in most states. Nevertheless, few if any states apply their anti-gambling laws to private poker games. But house games (in which pots are cut or raked for a profit or during which players pay collection fees) are vulnerable to legal action in most states.

Table 23 gives information about the legal and tax status of poker in each state.

_______________________

21Carmack v. Commissioner of Internal Revenue. 183 E 2d l (5th Cir. 1950).

22According to the United states Excise Tax Regulation 4401 (paragraphs 4020-4032) poker winnings are not subject to the 10 percent excise wagering tax. And according to Regulation 4411 (paragraphs 4075-4083) poker players, even professional players, are not required to register and purchase the wagering Occupational Tax stamp.